When the Growth Playbook Breaks

Use the Four Fits framework and AI to Pivot, Align, and Scale in the AI Era

I got to teach several cohorts of students this week. I started the week connecting with the

community and focusing on AI tools for Executive Presence. Later in the week, I dove into the Four Fits framework, one of the tools I teach in my course Business Skills for PMs, and that I want to share with you today. We had a Q&A at the end of the chat, and the recurring theme was that students kept asking, “Which is the most important?” The unfavorable answer is that you need to think about the system and system effects but start with the most broken and adjust. Just focusing on one is not sufficient. So let’s get into it.The Four Fits Framework

’s Four Fits are:Market <> Product: Is the market ready for your product? Do your users love it?

Product <>Channel Fit: Can you reliably reach them?

Channel <>Model Fit: Can your business model afford that growth motion?

Model<>Market Fit: Is the market big enough and ready to justify your model?

Nextdoor: Pre vs. Post COVID Fits Case Study

One important segment of Nextdoor’s user base was local business owners. Think plumbers, bakers, and coffee shop owners. These businesses mattered because neighbors were actively looking for trusted local services, and those conversations were already happening on the platform. Local businesses valued their Nextdoor presence because they could connect with their most important customers, their neighbors.

As the GM of Local Business, this was my focus: How do we engage these local businesses, build something genuinely useful for them, and ultimately create a product they’d want to pay for?

Before COVID, our strategy was high-effort and sales-led. We operated like many marketplaces before us think Uber, OpenTable and Square and focused on building liquidity in specific neighborhoods. We used performance marketing on platforms like Meta and boots-on-the-ground outreach to get local businesses signed up. The playbook was: create a free listing, post deals to neighbors, and eventually convert to a paid subscription.

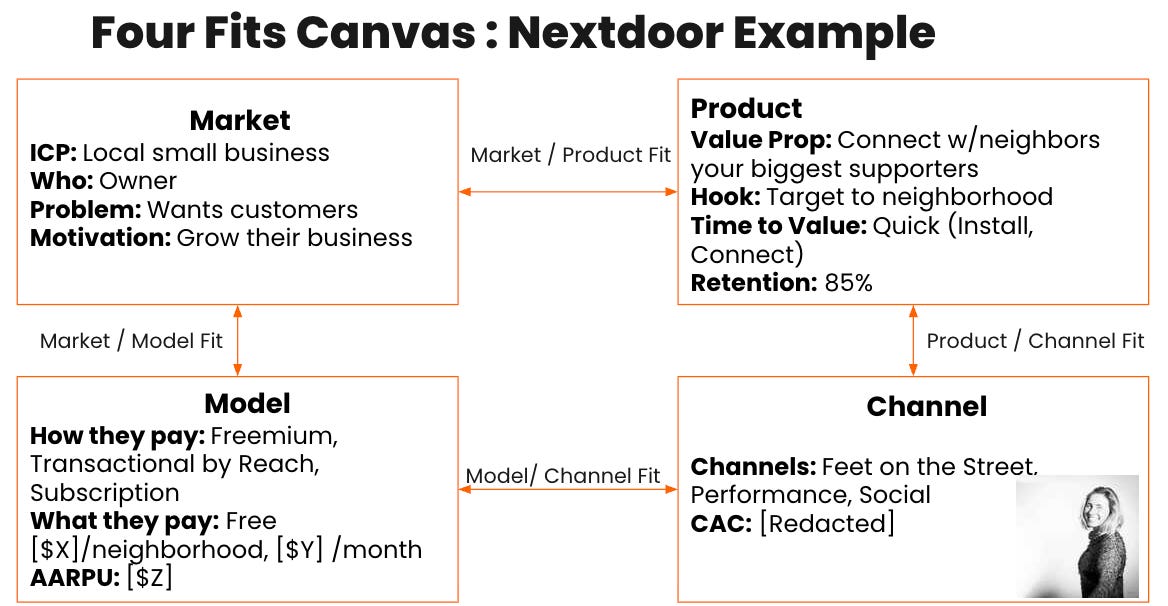

Here was our Four Fits Canvas before Covid.

Then COVID hit. Overnight, 50%+ of local businesses shut down. Performance marketing stopped working. Sales reps couldn’t knock on doors, let alone be outside. We threw out the marketing playbook.

…and we pivoted.

We made three immediate changes:

Paused paid marketing to preserve capital.

Shifted to partnerships and PR as our primary acquisition channels.

Launched a Local Business Bundle to help SMBs survive.

Our Four Fits Canvas changed to this during COVID. It had to continuously adjust as markets opened up, channels changed, and so did our product.

The product business bundle let businesses quickly add gift card, donation, and delivery links to their profile at no cost. We partnered with platforms like DoorDash and Uber Eats and prioritized fast integrations that gave SMBs a way to earn revenue immediately. Instead of pitching ROI, we focused on getting money into local business pockets today and leveraging neighbors, the people who cared the most about local business survival.

And we amplified everything with human-centered PR. We told stories about neighborhood ice cream shops staying afloat and local business owners adapting in real time. Here is my conversation with

, if you want to get deeper into the Nextdoor example and get the story behind our transition.By focusing on community value, trust, and rapid collaboration across product, marketing, and partnerships, we didn’t just preserve the local business unit. We grew it. At IPO, it represented 30% of revenue. Today, it’s even more.

The objective of the business case is to think about your product as a 1) System 2) a fluid System.

What Happens When a Fit Breaks?

Weak Market<>Product Fit

You’re solving a nice-to-have problem or targeting the wrong customer.

E.g. Segway, Market-Product Fit Breakdown

Segway had revolutionary technology and massive media hype, but the market wasn't ready for personal transportation devices like these. Plus the $5,000 price point was prohibitive. Cities banned them from sidewalks, and riders felt socially awkward using them in public. Segway built a technically sophisticated product but misjudged market readiness. People wanted better, more portable urban mobility without the cost, regulatory complexity, and social stigma. The company sold only 140,000 units over nearly two decades before being discontinued in 2020.

Weak Product–Channel Fit

Your product doesn’t “sell itself” in the channel. An example is PLG in a sales-driven organization, if not layered correctly, or the target users are just not the right ones.

E.g. Quibi (Product-Channel Fit Failure)

Quibi had strong product-market fit signals—premium content, mobile-first design, and clear user demand for short-form video. But they ignored product-channel fit entirely. Their $1.75B in funding went toward expensive content and celebrity partnerships (a high-CAC acquisition strategy) while their product couldn't be shared on social media—the primary discovery channel for video content. They built a mobile video platform that was incompatible with how people discover and share mobile videos. Strong product, wrong channel strategy, dead in 6 months.

Weak Channel–Model Fit

CAC > LTV. You can’t afford paid ads or outbound to support your pricing

Common in B2C with low pricing but high CAC channels

E.g. Blue Apron, Channel-Model Misalignment

Blue Apron had strong product-market fit with busy professionals loving meal kit convenience with a touch of freshness that Blue Apron delivered, but their channel-model fit was fundamentally broken. They were spending $150-over $400 to acquire each customer through Facebook and Google ads while their average customer lifetime value was only around $240. Their low-margin grocery business simply couldn't afford high-CAC digital advertising channels. The company went public at a $2B valuation in 2017 and sold for $200M in 2020—a 90% decline driven by unsustainable customer acquisition costs.

Weak Model–Market Fit

Your pricing doesn’t match buyer psychology or budget. Things like annual contracts in a startup-heavy market, or B2B where competitors turning away from subscriptions

E.g. Google+ , Model-Market Fit Misalignment

Google+ had solid product-market fit (people wanted better social networking) and unlimited channel reach (Google's distribution). But their model-market fit was broken. They tried to apply Google's advertising model to social networking, but users weren't ready to have their social graphs monetized the same way as search queries. The market wanted authentic social connection; Google's model required data harvesting that felt invasive in a social context. Great product, infinite reach, wrong business model for the market moment.

Exercise to Find the Broken Fit

1. Write your product or feature

2. Walk through each Fit with these questions:

3. Circle or star the weakest Fit.

4. Write 1–2 sentences about why it’s broken and what signal told you that. Then start the conversation with your team, and try one of the AI tools and prompts I walk you through next to get back on track.

AI Tools for Each Fit

If you’re trying to interrogate your GTM motion, AI can be your co-pilot—fast, generative, and non-judgmental as you are pressure testing each of the fits and building your systems thinking. Here are suggested tools for each of the fits, use cases, and how to leverage each one.

Product<> Market Fit AI Tools to Leverage

Product Channel Fit AI Tools to Leverage

Channel Model Fit AI Tools to Leverage

Model Market Fit AI Tools to Leverage

Foundational ICP Prompts with Data Inputs

Create a Rich Persona and ICP

Prompt:

"Act as a product marketer. Based on this CRM/customer data:

[Insert: job titles, industry, company size, usage stats, NPS scores, Sales data, past marketing information, user research],

create an Ideal Customer Profile for our [product category] offering. Include: goals, pain points, buying triggers, and objections."

Secondary prompt.

”Extract the words that my ICP is using to describe themselves and their painpoints and write their specific value statements”

Leverage the tools I mention above to gather said CRM+Customer data.

Where to get the data:

Your repository of customer interviews

Segment Comparison

Prompt:

"Compare these two customer segments based on conversion rate and retention:

[Insert: Segment A profile], [Insert: Segment B profile].

Who has higher urgency to buy [product], and what differentiates their pain points or activation moments?"

“How do they talk about the product? What are the adjectives they use? What are the painpoints they describe? How do they talk about customer value?”

Where to get the data:

Problem to ICP Mapping

Prompt:

"We solve [Insert: core problem statement or Jobs-to-be-Done].

Based on recent support tickets, sales calls, and search terms, who are the people most likely to be actively looking for a solution?"

Where to get the data:

Anti-Persona

Prompt:

"Here’s a list of churned or unqualified leads:

[Insert: churn reasons, firmographics, usage behavior].

Based on this, generate an ‘anti-persona’ — who we should not target in future campaigns."

“Review our current campaigns and tell me which campaigns target the anti-persona. Pull the associated conversion data for those campaigns that target the anti-persona”

Where to get the data:

CRM disqualification reasons (Salesforce, HubSpot)

Churn surveys or exit interviews

Synthesize Voice of Customer

Prompt:

"Summarize and cluster pain points from these interview transcripts and NPS responses:

[Insert: raw interview/NPS data].

Identify patterns in job roles, language, and desired outcomes."

Where to get the data:

Behavioral Insight Prompt

Prompt:

"Here’s anonymized user behavior data from our top 100 retained customers:

[Insert: features used, login frequency, integrations connected].

What behavioral patterns define high-fit users, and how can we use this to refine our ICP?"

Where to get the data:

Competitor Crosswalk

Prompt:

"Analyze the ICP for [Insert competitor name] using their public website, case studies, customer logos, and pricing tiers.

Compare that to our own ICP: [Insert your current ICP].

Where do we overlap, and where could we differentiate?"

Where to get the data:

GPT or Claude

Market<>Channel Fit

Prompt:

"Given this ICP description: [Insert target persona + firmographics] and these past channel metrics:

[Insert: CAC, CTR, CVR per channel],

Recommend top 3 acquisition channels and personalized messaging hooks per channel."

Where to get the data:

Lifecycle Persona

Prompt:

"Here’s our customer lifecycle data for [Insert ICP]:

[Insert: days to onboard, first value moment, expansion trigger, churn cause].

Map out how their needs and objections evolve across the lifecycle."

Where to get the data:

Product analytics (Amplitude, Mixpanel)

Onboarding funnel (HubSpot, Intercom)

Customer success tools (Gainsight, Catalyst)

Prioritize the Right ICP

Prompt:

"We currently serve multiple segments: [Insert list with conversion rate, LTV, and sales cycle per segment].

Based on these signals, help us narrow to the most valuable ICP to prioritize this quarter."

Where to get the data:

LTV model (spreadsheet or analytics layer)

Sales and marketing pipeline data

Q&A

Q: I feel like I’m using all the right channels and tactics, but something still feels off. How do I know when it's time to change the strategy?

A: This is one of the most common symptoms of a broken Product–Channel Fit. When you're doing "all the right things" but noticing drift—like your CAC is going up, conversion funnel is flattening, or your best channels are plateauing—that's often a sign your fit is breaking down, not that you need to execute harder.

Start by modeling out how your spend compares to revenue across different channels over the past 6 months. Look for patterns: Are certain channels saturating? Has SEO been displaced by AI tools changing search behavior? Are you competing against bigger players who can outspend you?

The other opportunity is examining your anti-persona. Sometimes in an effort to grow, we start going after everyone, which dilutes the effectiveness of our channels. If your messaging has become generic to appeal to a broader audience, your conversion rates will suffer even in previously strong channels. Try re-tightening your ICP and see if that improves performance before abandoning channels entirely.

Q: How can AI help us better understand and validate our business model and market assumptions?

A: AI excels at pattern recognition and simulation, which makes it perfect for stress-testing your Channel–Model Fit and Model–Market Fit assumptions. You can use GPT, Claude, or Gemini to model different LTV scenarios, simulate CAC changes across channels, and even test price sensitivity based on your customer data.

For TAM validation, try this approach: plug your ICP characteristics into LinkedIn Sales Navigator or Apollo to get a baseline count, then use AI to help you model adoption curves and market penetration rates. You can feed it competitor data, industry benchmarks, and your own conversion metrics to get more realistic projections than simple top-down math.

The real power comes when you use AI to simulate "what if" scenarios. What if your CAC increases by 30%? What if a key channel disappears? What if customers become more price-sensitive? AI can help you model these scenarios quickly and identify which fits are most vulnerable to external shocks.

Q: What tools do you recommend for identifying new channels or validating the ones we’re already using?

A: For channel discovery, SparkToro is useful, it tells you where your audience actually hangs out, what podcasts they listen to, what websites they visit, and what hashtags they use. This goes beyond guessing and gives you data-driven channel insights.

Browse AI is excellent for monitoring emerging communities and platforms. You can set it to scrape relevant Reddit threads, Discord servers, or niche forums where your ICP might be gathering. This is especially useful for B2B products where decision-makers congregate in industry-specific communities.

For validation, focus on leading indicators rather than just conversion metrics. Look at engagement rates, time-to-convert, and customer quality scores by channel. A channel with lower conversion but higher LTV customers might be more valuable long-term. Use your existing analytics stack (Amplitude, Mixpanel, etc.) to track these patterns, and consider tools like Attribution.com for more sophisticated multi-touch attribution.

Q: How do I bring cross-functional teams—like finance or analytics—into this process?

A: Bring them in early and make them co-creators, not just reviewers. The Four Fits framework is inherently cross-functional—finance owns the model economics, marketing owns channel performance, product owns the market fit—so you need everyone's expertise to map the system accurately.

Start with a collaborative mapping session where each team contributes their piece of the puzzle. When we did this at Nextdoor, we had R&D, marketing, and finance all in the same room building the plan together, not sequentially. Finance helped us understand unit economics constraints, marketing shared channel performance data, and product brought user research insights.

Create shared metrics that everyone can rally around. Instead of product tracking DAU while marketing tracks CAC and finance tracks burn rate, establish system-level KPIs that show how the fits are performing together. This prevents optimization silos and ensures everyone understands how their work affects the broader system.

The key is positioning this as strategic planning, not just another product framework. When finance sees how channel changes affect their forecasts, or when marketing understands how product changes impact their conversion rates, they become invested in the outcome.

What's Next?

The Four Fits framework is most powerful when it's applied and refined through real experience. I'd love to hear how you're using it:

Try the 4-step diagnostic with your current product this week and drop a comment below about which fit surprised you most. Was it the one you expected to be weakest, or did mapping the system reveal a different vulnerability? What were the knockon effects?

Share your own examples - Have you seen companies (or your own teams) succeed or fail because they optimized one fit while ignoring the others? The best learning happens when we share our stories, especially those where not everything was perfect and we learned something.

What tools are working for you? The AI landscape moves fast, and I'm always looking for new prompts and platforms that help product leaders think more systematically about GTM. If you've found something that works, the community would benefit from your insights.

If this framework resonated and you want to go deeper, hit the like button and share this post with other product leaders who are wrestling with GTM challenges. The more we can shift the conversation from "find product-market fit" to "optimize the system," the stronger our products and businesses become.

And if you're ready to master the full toolkit of business skills that separate strong operators from true business leaders, join my next cohort of Business Skills for Product Leaders. We'll dive deep into frameworks like this one, with real case studies, AI tools, and hands-on application to your work.

What questions do you have about applying the Four Fits to your situation? Comment below - I read every response and often turn the best discussions into future deep dives.

This is a reader-supported publication. Your likes, shares, and comments help more product leaders discover frameworks that can transform how they think about building businesses.