We had two uncharacteristically warm days in San Francisco, and I've been reflecting on what truly transforms a good product leader into a great one as we constantly work through how to deliver value for our customers. With many companies going through quarterly planning, I wanted to share something that's been transformative in my own career journey.

Last week, I taught a Lightning workshop on Building P&L models that Win Executive Trust. The response was incredible – over 320 builders joined to learn this critical skill that's often the invisible ceiling preventing talented PMs from advancing to VP, CPO, and GM roles.

To spotlight my April cohort of Go-to-Market Strategy for Product Leaders (April 15-24), I wanted to share the key insights from this workshop. This course has been featured in

’s and Maven’s growth collections as one of the critical focuses for product leaders across tech who are looking to bridge the gap between shipping features and driving business impact.You're here because you recently subscribed or signed up for one of my resources—my course waitlist on Maven, lightning lesson. If someone sent you this post and you're not subscribed, join those people learning how to advance the business they are working on and provide value for their customers.

Why Financial Fluency Matters

I still remember sitting in a budget meeting at Nextdoor, passionately explaining our plans for a new mapping feature. I had user research, engagement metrics, and a beautiful roadmap. Then the CFO asked: "What's the payback period and ROI?"

I froze.

That moment crystallized something I've seen repeatedly: brilliant product leaders hit a career ceiling when they can't translate product metrics into financial language. So learn from me, and come prepared to the conversation.

At senior levels (Director → VP → CPO → GM), your job expands beyond shipping great products to:

Allocating limited resources across competing priorities

Defending budgets during downturns

Securing investment for transformative initiatives

Navigating market shifts with confidence

These require thinking in P&L terms—and speaking the language of executives.

What is P&L

P&L stands for Profit and Loss – a financial document that summarizes a company's revenues, costs, and expenses over a specific period. It's also called an "income statement" and shows whether a company is making money or losing it, and what contributes to that.

I wanted to start with an example of 2 pen companies, one that buys the pens and sells them, and another that buys the pen components and assembles them, to ground us in the fundamentals.

Scenario 1: Company buys completed pens and sells them

Revenue: Money from selling pens ($100,000)

Cost of Goods Sold (COGS): Cost of purchasing the pens from supplier ($60,000)

Gross Profit: Revenue minus COGS ($40,000)

Operating Expenses: Salaries, rent, marketing, etc. ($25,000)

Operating Profit (EBITDA): Gross profit minus operating expenses ($15,000)

Net Income: After taxes, interest, etc. ($12,000)

Scenario 2: Company buys pen parts and assembles them

Revenue: Still the money from selling pens ($100,000)

Cost of Goods Sold: Cost of pen parts ($40,000)

Gross Profit: Higher because parts cost less than completed pens ($60,000)

Operating Expenses: Higher because we need assembly staff, equipment ($45,000)

Operating Profit: Might be the same or different depending on efficiency ($15,000)

Net Income: After taxes, interest, etc. ($12,000)

The key difference? In Scenario 2, we've shifted costs from COGS to Operating Expenses, which affects our gross margin (but might not change overall profitability). This distinction matters tremendously for how executives evaluate business health.

The Translation Gap

Product leaders typically excel at product metrics—DAU/MAU, engagement, retention, conversion. These are necessary when speaking to the EPDD team to convey information, get buy in and overall deliver. However, insufficient when talking to executives who operate in the context of different metrics that they care about.

Here's the translation guide I wish I'd had earlier in my career:

When you frame your work in these terms, you immediately elevate the conversation to the executive level decision rather than a feature one. It is not a comprehensive list but hopefully a starting one to change your perspective.

A Real P&L Example: The Nextdoor Maps Project

At Nextdoor, we considered launching a local maps experience to enhance neighborhood discovery. Instead of just pitching the user experience benefits, I built a detailed P&L model that translated the impact, time horizon and scenarios that we may encounter along the way. Below, is fake data, but the line of thinking should hopefully be useful in thinking through your product, business model and revenue drivers to map your product to business impact.

The Product Vision: Transform how users experience their neighborhood by letting them see events, items for sale, and local businesses through an interactive map.

Base Metrics (fake):

Start with user metrics: 8.5M DAU with projected 25% map engagement

Translate to engagement: Additional 5.8 minutes per engaged user

Convert to revenue: New ad impressions at $3.20 CPM plus premium business placements

Factor in costs: Data providers (Google Maps API, Foursquare), engineering (3 FTEs), product/design teams

From this model our your projected revenue. Here is an example for the maps case.

Revenue Inputs

Cost Inputs

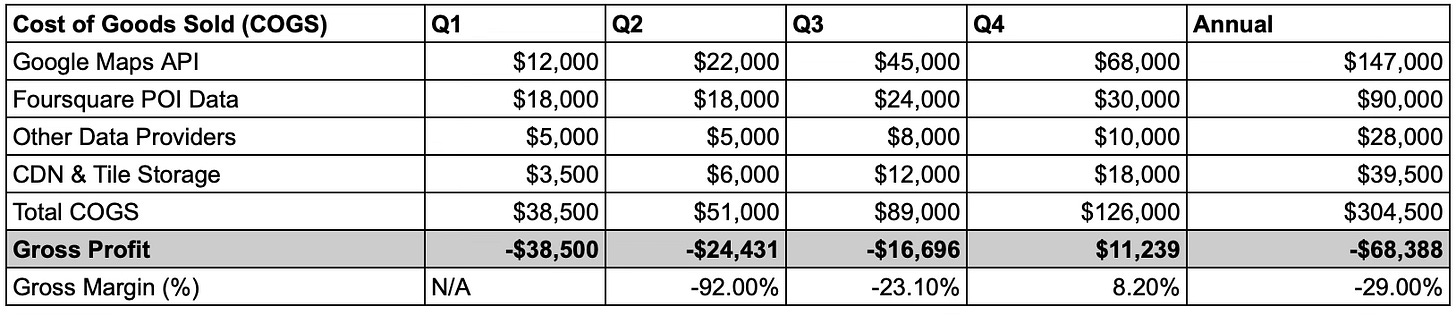

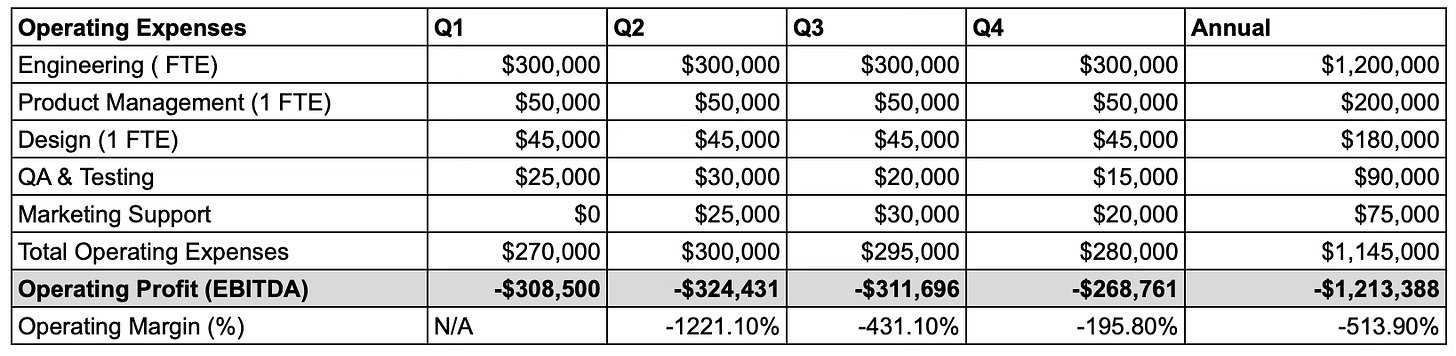

Next think through what goes into delivering your product. For maps we needed data, and lots of it, and that had a substantial cost for the delivery of our product. Other things you may consider is storage, hosting etc.

Operating Expenses

What are the people costs involved in building this product, maintaining it and bringing it to market? What are the additional costs for supporting those people? For the maping project we needed to think about the builders, how we ensure the product is of high quality and who will take it to market.

Scenario Planning: The Trust Builder

The secret to winning executive trust isn't perfect forecasting—it's showing you've thought through different outcomes so that you can strategically shift focus when you need to, instead of just reacting.

For the mapping project, we modeled four scenarios:

Base Case: Our realistic projection

High Adoption: 25% higher usage, creating opportunities for premium listings

Low Adoption: -40% lower usage, requiring scope simplification

Data Cost Increase: 30% higher COGS, necessitating alternative providers

This approach demonstrated we weren't just optimistic about our feature—but it forced us to think through contingency plans for various outcomes, and showed the board that we had a deep grasp of the inputs and thus much more in command.

The CFO later told me: "This is the first product presentation where I didn't have to ask 'but what if it doesn't work? and have you thought about?”

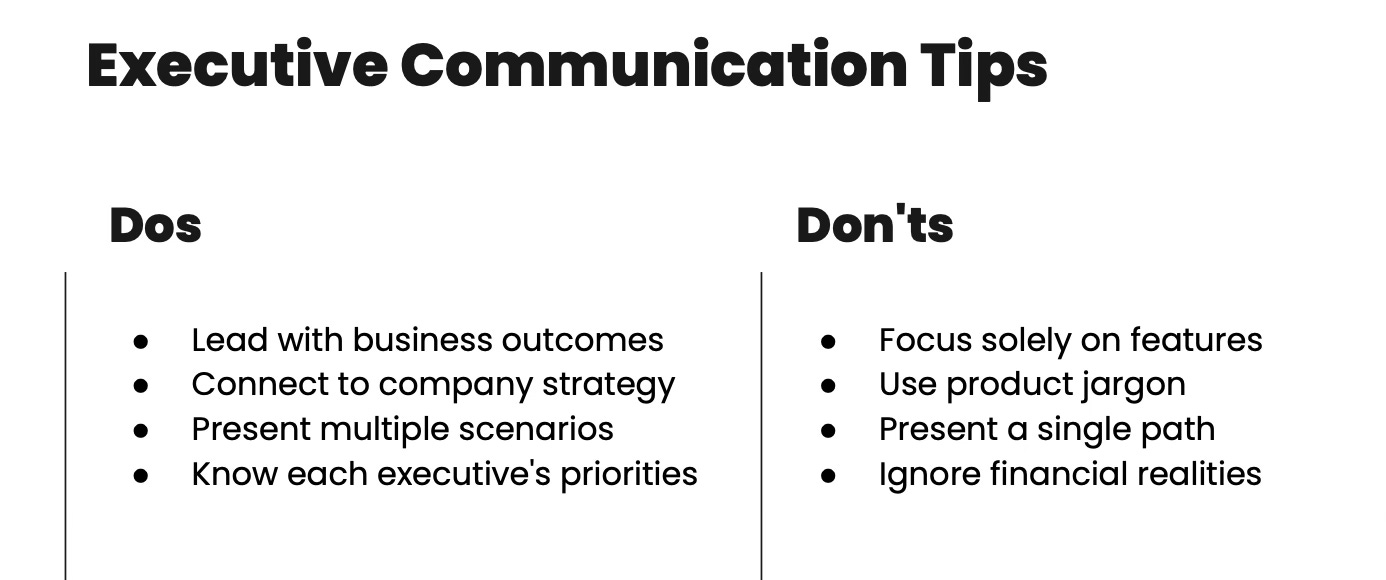

Executive Communication Tips

One of the perspective changes for you is to move from thinking about working in the business to working on the business and constantly reassessing what value am I providing to my users and how is it moving the business forward.

Avoiding Common P&L Mistakes

In building countless P&L models across different business models, I've noticed patterns in what trips up product leaders:

Underestimating costs: Data costs, third-party services, and infrastructure often balloon beyond initial estimates

Overoptimistic revenue projections: Your "realistic" case is probably your "best case"

Ignoring seasonality and timing: Launches have different impacts depending on business cycles

Not accounting for cannibalization: New features can steal from existing revenue streams

Using the wrong metrics for your business model: Ad, subscription, and transaction businesses need different frameworks

Ready to Transform Your Product Leadership?

If you're serious about advancing your career and making a bigger impact, I invite you to join my "Go-to-Market Strategy for Product Leaders" course starting April 15th.

In this comprehensive 4-day program (April 15, 17, 22, 24), you'll get:

GTM Strategy Design: Transform features into market opportunities with frameworks I've used to scale products across Braintrust, Nextdoor, Opentable

Financial Fluency: Master building compelling business cases that get executive buy-in, with hands-on practice and feedback, we go deep and make the lesson immersive, so you get into the spreadsheet and comfortable with the formulas

Executive Presence: Develop skills to align executives, R&D, and GTM teams around your vision, including board-level presentation practice

Growth Execution Engine: Learn to launch products that drive immediate revenue impact through proven templates and case studies

P&L Workshop Video Outline with Timestamps

00:00 Introduction and Speaker Background

Elena's experience at GoFundMe, Braintrust, Nextdoor, and other companies

Overview of upcoming "PM to GTM" course

01:35 P&L Fundamentals

Basic structure of a profit and loss statement

Revenue, Cost of Goods Sold, Gross Profit

Operating Expenses and EBITDA

03:10 Translating Product Metrics to Financial Language

Why CFOs don't care about DAU/MAU

Connecting retention to lifetime value

Transforming engagement into revenue per user

04:35 Real-World Case Study: Nextdoor Maps Product

Setting the context for a mapping feature

Assumptions around user engagement and monetization

06:15 Building the Financial Model

Projecting DAU and feature adoption rates

Converting user engagement to advertising revenue

Forecasting revenue growth across quarters

09:40 Understanding Cost Structure

Breaking down data costs (Google Maps API, Foursquare)

Infrastructure scaling considerations

Team resource allocation (Engineering, Product, Design)

12:30 Key Business Metrics and ROI Calculation

Project development stages

Cumulative investment tracking

Breakeven timeline analysis

Multi-year ROI projections

14:20 Scenario Planning for Different Outcomes

High adoption scenario (+25% usage)

Low adoption scenario (-40% usage)

Data cost increase considerations

New revenue opportunity modeling

17:45 Executive Communication Tips

Leading with business outcomes, not features

Connecting to company strategy

Understanding stakeholder priorities

Avoiding common financial presentation mistakes

21:15 Common P&L Mistakes to Avoid

Underestimating costs

Overoptimistic revenue projections

Ignoring seasonality and timing

Using the wrong metrics for your business model

23:30 Closing and Course Information

Overview of "PM to GTM" course

Q&A and resources

Thanks for reading! If you want to hear more applicational content on how to build valuable products and get them adopted in the market, subscribe!

Share this post